![]()

![]()

Electronic commerce in Brazil is a reference for all of Latin America. This country, with one of the strongest economies on the continent, has directed its steps towards digital trends and online purchases to offer a better consumer experience.

In 2022, eCommerce in Brazil reached an expense in online sales of 39,590 million dollars (37,224 million euros) according to data from the Digital 2023 study corresponding to the country itself, prepared by We Are Social and Meltwater. Likewise, the forecasts suggest that revenue from online sales will continue to grow to reach 47,635 million dollars (just over €44,000M) in 2023 and that in 2027 they will stand at 82,257 million dollars (€77,341 million).

How Brazilians shop online

The country of Rio de Janeiro has a population of 215.8 million inhabitants (almost 5 times more than the population in Spain) of which 84.3% (181.8 million Brazilians) has internet access. During the last year, the Internet user population increased by 4.1%.

As with many markets around the world, e-commerce is transforming the way products are sold in Brazil. And it is that during 2022, 123.8 million Brazilians made their purchases through digital media. Of these, 47.5% used their mobile phones to carry them out.

On average, each user spends $320 (€300) per year on your online purchases. Despite the fact that user spending is relatively low compared to European countries that exceed one thousand euros (such as France or Italy), the large number of people who buy online make electronic commerce flourish.

As in some international markets, the main purchase motivator for users is that the eCommerce offers free delivery with purchases (70.2%). Although for more than half of the population (55%) the coupons and discounts they find inclines them to buy and the opinions of other consumers in comments or internet reviews, are important to 43.8% of online consumers.

Other motivators are: a quick and easy checkout (42.9%), tax-free payments (40.8%) and next-day delivery (40.5%).

Current trends in the Brazilian online scene

Throughout the world, social networks have taken an essential role as promoters and allies of electronic commerce. In the case of Brazil, 44.4% of users use them to find inspiration to do or buy things, while 41.4% use them to search for products to buy.

Likewise, regarding the use of the Internet, the search for products and brands is the fourth main use that Brazilians give to search engines (70.6%).

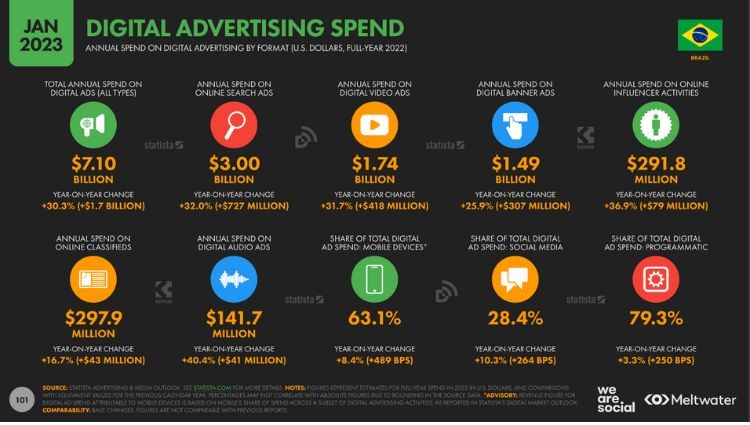

For their part, industries and brands invest large amounts of money in online advertising. This investment stood at 7,100 million dollars (about €6,675M) in 2022, which in addition to being above the spending of European countries such as Italy or Portugal, had an exponential increase of 30.3% compared to 2021.

In turn, this expense is spread across different online advertising formats, with online search ads accounting for the largest part of this budget, with 3,000 million dollars (about €2.82M). In second place are digital video ads (€1,636M), followed by digital banners (€1,400M).

Most common payment methods in Brazil

One of the factors that has promoted electronic commerce in Brazil is bank access. The country has evolved considerably in terms of financial inclusion, which is why 83.6% of the population has a bank account.

As a result, digital payment methods such as debit or credit cards are used by more than half of Brazilians (53%), this being his favorite payment method when buying online. Similarly, payments through electronic wallets and bank transfers are widely accepted, each being chosen by 15% of consumers.

What and where do Brazilians buy online?

Unlike other markets, where fashion is the most sold category online, in Brazil the most popular category is technology, an industry that moved 13.350 million dollars (€12,552M) in eCommerce sales in 2022, despite the fact that it decreased by 1.5% compared to the previous year.

In second place, and with a growth of 11.2%, fashion was the second most sold category on the internet (€7,324M), followed by personal and household care (€6,083M) in third position and food (€3,883M) in fourth.

During 2022, the weekly purchases of second hand items had a significant decrease of 10.3% and currently, only the 10.4% of the population buys them with this periodicity. For its part, the weekly use of online price comparison sites also fell by 4.4%, although 32.7% of users continue to use them.

Most visited online stores in Brazil

As for the e-commerce websites with the highest traffic, the Semrush data reflects a mixed picture that mixes both Latin American platforms and global giants. MercadoLibre and Amazon (with its local domain) are the ones that accumulate most of the monthly visits.

Free market (.br): The Amazon of Latin America accumulates 185.19 million visits. Amazon (.br): with 182.44 million visits. AliExpress (.com): the Asian e-commerce giant has 100.50 million visits. Magazine Luizto (.com.br): one of the retail chains in Brazil specialized in electronics, registering 96.00 million visits. OLX (.com.br): marketplace with 81.36 million monthly visits. Shopee (.com.br): another Asian platform that accumulates 66.68 million visits. Americanas (.com.br): one of the most important retail chains in the country with 48.44 million visits. Kabum (.com.br): an eCommerce specialized in technology with 31.35 million visits. Casas Bahía (.com.br): online store specializing in furniture and household appliances, with 29.19 million visits. Amazon (.to): with 27.33 million visits.

Photo: Depositphotos

Stay informed of the most relevant news on our Telegram channel