![]()

![]()

Amazon has just presented its results corresponding to the closing of the fiscal year 2022 and, for the first time since 2014, it has broken its profitable streak. Despite having increased its turnover, the technology giant has registered losses worth $2.7 billion (close to 2,480 million euros).

How much has Amazon entered

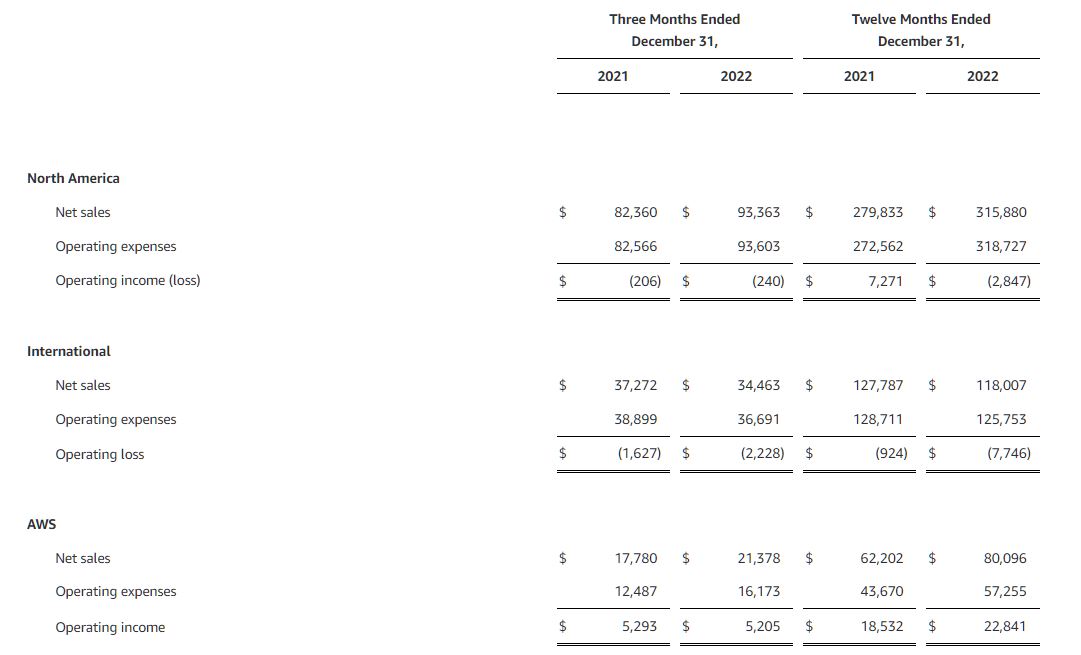

According to the figures presented by Amazon, in 2022 managed to increase its income by 9%placing them in the 514,000 million dollars (472,000 million euros), compared to 469,800 million dollars (just over 431,400 million euros) in 2021.

Of course, it should be noted that the highest sales volume occurred in North America, which reached 315,900 M$ (290,000 M€) after growing by 13%. However, international sales decreased by 8%remaining at 118,000 M$ (108,300 M€).

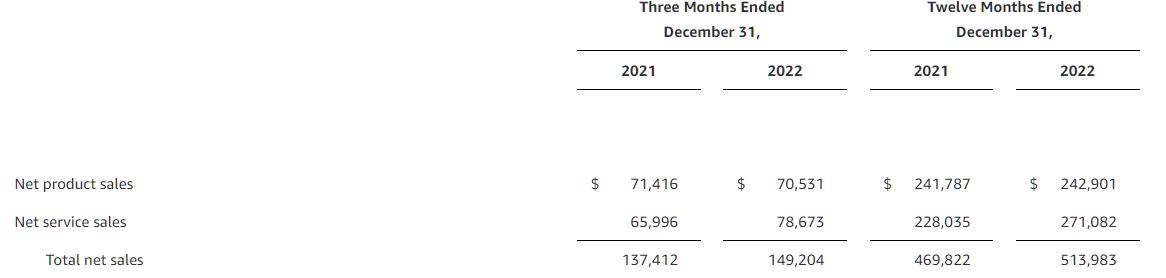

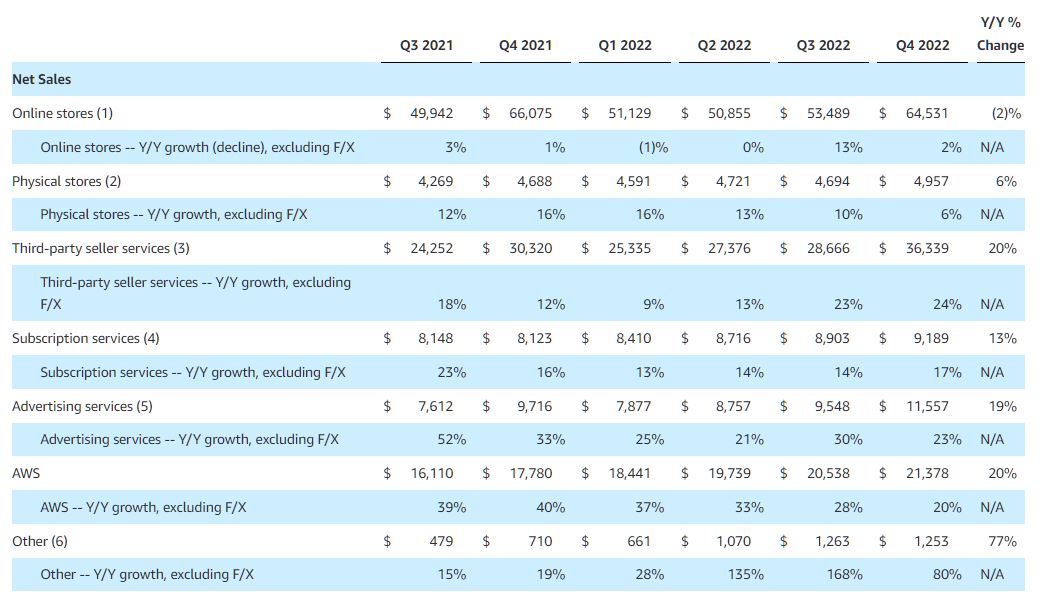

In addition, AWSits cloud service and one of Amazon’s best cards today, experienced a 29% revenue growth, standing at 80,100 million dollars (just over 73,500 million euros). In general, the entire Amazon service area has achieved great results, growing by 18.8%. In fact, right now Amazon already earns more from the sale of services (such as those of AWS, advertising, subscriptions…) than from product sales: $271,000M (€248,000M) vs. $242,000M (€221,000M). Revenue from the sale of Amazon products has only grown by 0.46%.

And more specifically, if we look at the breakdown of their sales, we see that revenue from online sales has fallen by 2% compared to 2021:

How much has Amazon lost?

The increase in the technology giant’s revenues has not been enough to present benefits at the end of 2022. Clearly contrast with its results of the previous yearwhen he got a net profit of 33.4 billion dollars (around 29,170 million euros), this time Amazon remains in the red.

The company has closed 2022 with $2.7 billion (about 2,480 million euros) in losses. As they explain in their statement, the loss of 12,700 M$ (11,663 M€) due to the loss of valuation of Rivianan electric car company in which Amazon has a significant stake, is one of the factors to be highlighted with influence on these results.

Let us remember that already during the first quarter of 2022, the company registered losses of 3,800 million dollars (about 3,600 M€), in its results and one of the main causes indicated was precisely the net loss of 7,600 million dollars (7,200 M€) due to its participation in Rivian.

Context of Amazon’s results: layoffs, stoppage of the growth of its network of warehouses…

He 2022 has been a difficult year for the digital sector, and the world in general, have had to moderate expectations and apply internal restructuring and business models, proof of this is the avalanche of layoffs that have been taking place in recent months among the big technology companies. Now, the results presented by Amazon make clear the difficulties facing the sector and the company itself.

To better understand the context in which Amazon’s current situation is framed, we must go back to last November, when the company announced that it would execute a cut out your template, laying off 10,000 employees. Figure that he raised by 80% at the beginning of 2023, announcing that they would finally be more than 18,000 workers laid off.

It should also be noted that, just a few days ago, Amazon announced the closure of one of its logistics centers in Spain, specifically that of Martorelles (Barcelona). The closure of this center, which currently employs 800 workers, will take effect on April 22. This would be a maneuver to reduce costs while the company is immersed in a process of modernization of its logistics network in Spain.

Despite inflation, the economic crisis in which we have entered and the figures that Amazon has just revealed, Andy JassyCEO of the company, has not hesitated to be optimistic. “In the short term, we are facing an uncertain economy, but we remain fairly optimistic about the long-term opportunities for Amazon… We believe our leading customer experiences in these areas, along with the results of our continued hard work and inventiveness to improve each day, will lead to a significant growth in the coming years«.

Putting all this in figures, is anticipated that the company obtain operating profit of up to $4 billion during the first quarter of 2023 and that the billing increases between 4% and 8% (oscillating between 121,000 M$ and 126,000 M$).

Photo: Depositphotos

Stay informed of the most relevant news on our Telegram channel