Uncertainty is over: Wallapop, the popular Spanish sale app of second -hand, already has a new owner. The South Korean Naver, known as the “Korean Google”has closed the acquisition of 100% of the company for about 600 million euros. The operation, one of the most relevant in the Spanish startup ecosystem, has been sealed this morning after a shareholders' board marked by tensions between investors.

The big pitfall has been the price. The figure is a huge reduction with respect to the last wallapop assessment –806 million euros in February 2024—something that did not sit well in the fund 14W – second greater shareholder with around 20% of the capital – that firmly opposed the sale. However, the partner pact dragged 14W, racing the way for Naver, which already controlled 22% since 2023, took command.

Recall that Wallapop is one of the main references of the Spanish startup ecosystem. An icon for second -hand and firm candidate for years to reach the status of Startup Unicorn (valuation greater than 1,000 million dollars).

A tense vote with the advice of JP Morgan

The Board held in Barcelona, which lasted throughout the morning, put on the table the positions of the main shareholders. Insight Venture Partners (15.16%) and Accel (13.66%)with more than seven years in capital, they supported the sale. Your return will not be stratospheric – approximately 1.5 times the capital invested – but enough to close cycle.

The capital of Wallapop, however, is very atomized. Among the partners are historical investors such as Antai Ventures, GP Bullhound, Northzone and ICO itself, which with 3% of the capital has secured the recovery of its investment thanks to a “Liquidation Preference” clause.

JP Morgan advised the operation, which faced shareholders for the 600 million offered. 14W, led by Alex ZubillagaHe criticized that the price was a strong discount. However, sources close to the negotiation indicate that Zubillaga himself came to present a partial offer that Wallapop valued in just 450 million, although without change of control or acquisition premium.

What is Naver and why Wallapop interests

As we said, and for simplifying a lot, Naver is something like the “Korean Google.” A gigantic company with a total impact on the daily life of the 52 million inhabitants of South Korea.

Founded in 1999 (Just a year after Google launch), Naver is an integral web portal that offers much more than a search engine: An interconnected services ecosystem That include news, blogs (Naver Blog), communities (Naver Cafe), maps (Naver Maps, far superior to Google Maps in Korea), online purchases, payment services (Naver Pay) and a popular question and answer service (Knowledge in). Its success in Korea lies in having settled for years as the digital reference for the language and Corean cultural preferences, offering more relevant search results than its global competitors in the local market.

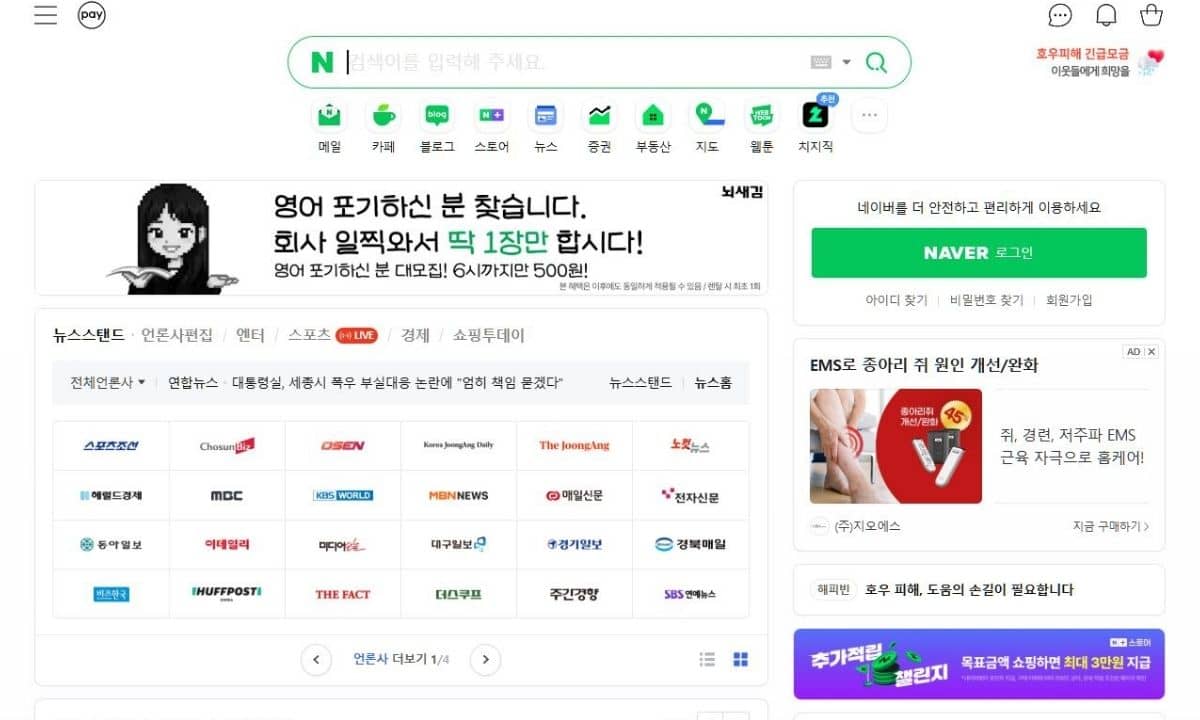

Naver.com cover

Naver.com cover

But in the current world technological panorama, Naver's relevance goes beyond his regional domain. The company is actively positioning themselves in fields such as Artificial Intelligence (AI), Extended Reality (XR) and the creation of immersive content. With AI tools such as Hyperclova X Think (its LLM model) and its investments in AI companies, Naver is building an integrated technological infrastructure. Its global strategy seeks to expand in areas where the US technological giants. And China do not have such a strong position, offering specialized AI and services solutions.

In 2021, Naver made the leap to Wallapop participating almost exclusively in a round of 75 million euros, and now, with this purchase, the total control of one of the most recognizable brands of the European ecommerce is ensured.

A powerful investor at a global level

Apart from the Wallapop case, Naver is also investing and expanding in key markets such as North America (with platforms such as Poshmark and the next launch of Thingsbook, a social network), Japan (through the popular messaging app LINE and Webtoon) and the Middle East, where he is collaborating in Data Centers and AI solutions.

In general, throughout his career, Naver has invested large sums of money in startups around the world. Thus, he has opted for businesses such as those of the American Twelvelabs, a startup specialized in AI for video, which analyzes visual content for contextual searches, detection of objects and understanding of visual language.

Just a few months ago Naver acquired the Korean Yanolja F& B Solutions to improve its services in the Korean restaurant market and explore opportunities in Japan, seeking the digital transformation of the restaurant industry. In addition, its financial technology subsidiary, Naver Financial, is in advanced conversations to acquire Asil, a Korean platform for real estate data based on Big Data. This acquisition seeks to strengthen Naver's profile in the digital real estate sector.

What will happen now with Wallapop

The platform faces a new stage under Naver's umbrella. Until 2023, according to the latest accounts deposited in the Commercial Registry, the company was in full consolidation of the national market and international expansion, with revenues of 89.63 million euros and losses of 30.4 million (improving the numbers of 2022, when it lost 50.59 million).

The declared ambition of Wallapop remains “to build a unique inventory ecosystem throughout Europe”, and with Naver's financial and technological muscle, that objective seems more attainable than ever.

Image: Wallapop